Money mule scam is becoming increasingly widespread all over the world. Many innocent people are trapped, losing their money and even facing judicial action.

Let’s understand what the Money Mule Scam is and how you can be safe from online fraud.

Suppose someone randomly contacts you and offers to deposit money into your bank account. They provide reasons such as having reached their account limit, wanting to avoid local government taxes or some other justification. Additionally, they promise you a sizable commission for your assistance.

What would you do? You stand to lose nothing and gain significantly through a straightforward transaction!

I don’t know about you, but many people in desperate need of money will undoubtedly accept the proposal. And that’s where the Money Mule scam comes into play.

What is the Money Mule Scam?

Taking over the bank accounts of ordinary people and making illegal transactions with them is called Money Mule Fraud. These fraudulent companies usually contact their potential victims and ask them to rent out their personal bank accounts or cards. In exchange for this rental, fraudulent companies offer a considerable commission to the account holder.

Once the account holder agrees to their terms, scammers ask for the bank details. When they obtain this information, they may engage in multiple types of fraud using the account holder’s identity, the bank, and often violate the law.

Mule Account

Accounts that are taken over by fraud companies or individuals are known as mule accounts. In professionals’ terms, “A mule account refers to an account that is used to transfer or receive funds acquired illegally on behalf of others.”

For example, a professional killer receives a job offer from an overseas client to commit a murder in exchange for a substantial sum. If the killer receives the payment directly into their own account for this international transaction, authorities may track the money, leading to suspicion of their involvement in the crime.

However, if the criminal rents one or more bank accounts in their country and uses these accounts to receive the payment before transferring it to their own account, they believe they can avoid detection.

Nevertheless, this action affects the actual account holder, who will inevitably come under scrutiny from the authorities and face legal consequences.

What type of fraud can be done by a Mule account?

Scammers can exploit Mule accounts for a range of illegal activities, including:

Financial Risk:

The primary risk stemming from sharing personal account details is financial. Scammers may transfer funds from your account to other accounts. If you willingly disclose your personal information, whether through mutual understanding or for business purposes, banks and authorities may hold you accountable for any associated fraudulent activity.

Criminal or Terrorist Activities:

Mule accounts may be used for anti-national activities by receiving international funding for terrorism and criminal endeavors. Organizations outside the country may rent multiple accounts to transfer funds to terrorists within your country for purchasing weapons or other necessities or to establish a presence in the nation.

Similar tactics may be employed for criminal activities, such as targeted violence or harm against individuals. Thus, Money Mule Fraud poses a risk to national security.

Note: Most information in this blog has been inspired from nidirect official website.

Drug or Weapon Trafficking:

Criminals employ various methods of drug or weapon trafficking, often utilizing Mule accounts to transfer money. In the Indian movie “Udta Punjab,” we’ve seen depictions of drug smuggling across borders.

While physical transport is not possible for money, Mule accounts serve as a means to facilitate financial transactions for such illegal activities. Furthermore, Mule accounts may also be used for human trafficking and other criminal acts.

How can scammers contact you?

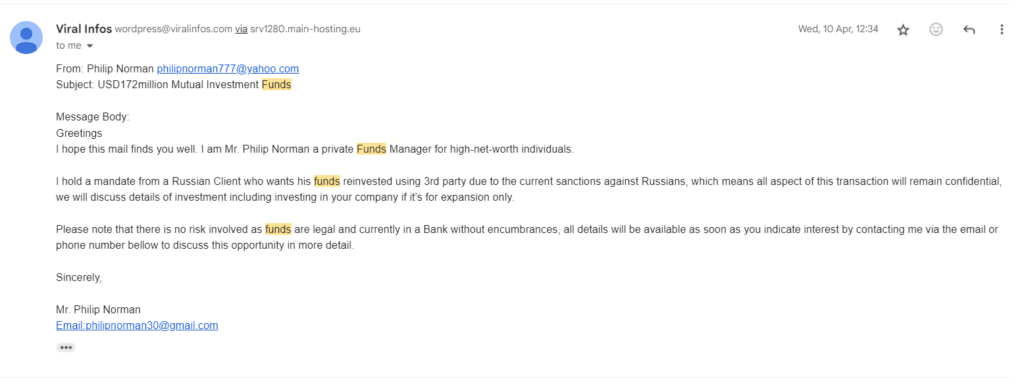

The Internet is the preferred mode of Money Mule Fraud. Most scammers contact individuals via email, social media platforms like Facebook or Instagram, and may request favors. They may also use Internet calls to initiate contact and perpetrate scams.

Viral Infos also received an email with the same intention of Money Mule Fraud. However, we do not allow scammers to use our accounts and strive to educate the general audience to stay safe.

What are the risks for account holders?

The most common and primary risk for individuals who share their banking details with others is the loss of funds from their accounts. Additionally, in frequent or suspicious transactions, banks may freeze the accounts.

In more severe situations, if funds transferred from an account are used for criminal, terrorist, or other illicit activities, the account holder may face legal action. They could be charged as fully responsible for any illegal activity resulting from their transactions, leading to potential imprisonment.

How to Avoid Money Mule Fraud?

Avoiding fraud is straightforward: never succumb to greed and share your bank or card details with anyone.

Don’t trust anyone online, even if they claim to be a relative. Scammers can hack into your loved one’s social media accounts or create similar IDs to deceive you.

Never disclose any personal, especially banking and card details, through unauthorized online applications. Keep OTPs from your bank private.

Also read: Fraud Loan Apps : Ways to Safeguard Yourself